Policy Updates: Business Tax Relief Ballot Measure

by Zac Unger, D1 Councilmember

(Originally published in his e-newsletter dated Dec. 26, 2025)

We each have our favorite small business in Oakland, whether it’s a restaurant or a clothing store or one of those uncategorizably odd little shops that sells uncategorizable odd little things. I would reveal my personal #1, but I can’t play favorites so I’ll lie and tell you that I love all the District 1 businesses exactly the same amount.

It’s no secret that doing business in Oakland isn’t easy. Crime, regulations, tariffs, and competition from online retailers and delivery services mean that some of the businesses that define Oakland are barely hanging on. And while most people don’t have the same visceral love for large businesses—nobody ever says “I love living in the same town as a mid-tier HR management software firm!”—these companies are vital to our economic recovery by providing jobs, tax revenues, and employees who enliven our streets and shop in our commercial corridors.

That’s why I’m incredibly proud to bring you a policy to help our businesses that I’ve been developing with Councilmember Ramachandran. This measure focusses on two particular categories of business: small retailers grossing less than a million dollars per year and new businesses just starting out in Oakland.

The first piece will eliminate gross receipts taxes for business grossing less than one million dollars per year. We are focusing this business tax relief on the types of businesses—A, B, E, G, and I for my tax-category nerds out there—that bring foot traffic and spark neighborhood vibrancy. This means restaurants, retailers, salons, and similar businesses that get shoppers out and about, the kinds of businesses we rely on in our daily lives.

The second piece is what we’re calling our First Year Free Program, and it applies to all businesses of any size and any category newly opening in Oakland. If your business is brand new to Oakland, you won’t pay any gross receipts taxes for the first year, up to a maximum savings of one million dollars. Companies have a lot of choice over where they establish themselves, so we want to give them an incentive to pick Oakland, get their feet under them in that first year, and be productive members of our business community for years to come.

Now we need your help to get it across the finish line! Because the voters set business tax rates through a ballot measure, the only way we can change them is through another ballot measure. If my council colleagues agree to put this on the ballot, then you’ll have a chance to vote on it in June of 2026. The ballot measure itself provides this tax relief for a single year, but allows us to extend it up to three times with a vote of the City Council. By the way, none of this means that we’re giving up our civic commitment to responsible business practices; companies still need to treat their workers right and safeguard our environment. Also, I’ve been thinking about this legislation since my first day in office, and I made a point to set aside more than enough money in the budget to cover the lost revenue. It’s already paid for!

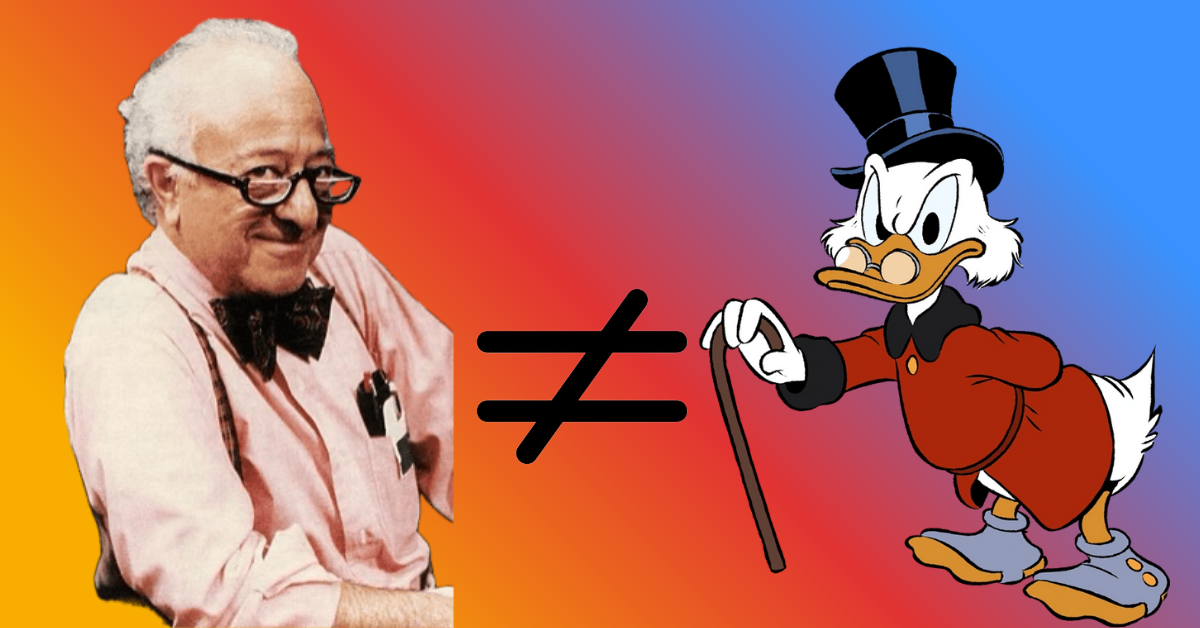

I want to be honest about the fact that City Hall has not always sent the message that we value our business community. That changes now. The small businesses we love are run by our neighbors; there are a lot more Mr. Hoopers than Scrooge McDucks. Companies both large and small are a key part of how we keep Oakland strong. I also want to acknowledge that this legislation doesn’t solve every problem; even with this tax relief, businesses will continue to have hard times. We can’t just pass this, claim victory, and move on. I hope this legislation is an early step towards giving companies the breathing room they need to succeed in Oakland. Lots more work to be done, but we’re sending the message that Oakland is open for business!